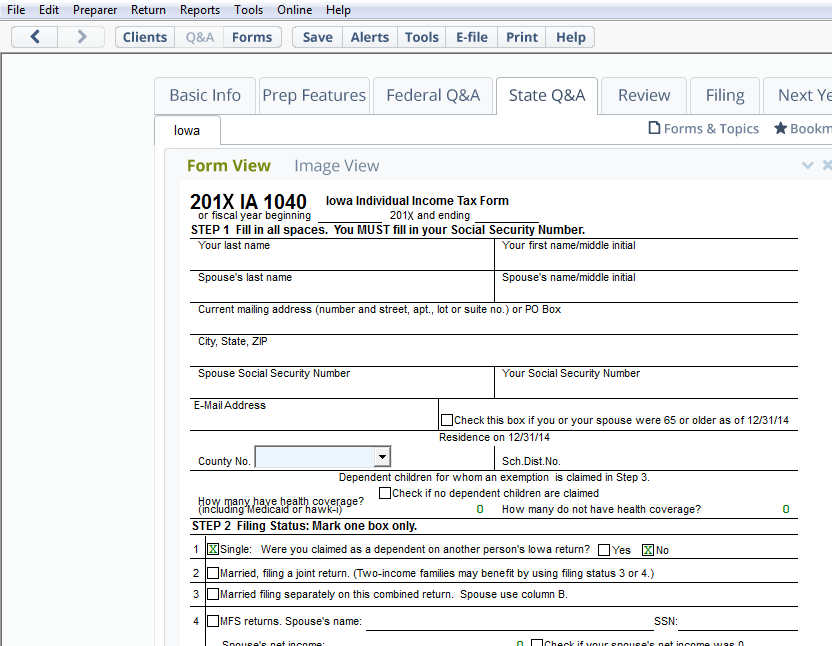

Prepare 1040 state taxes with ease

TaxAct 1040 State Editions fully integrate with TaxAct 1040 Federal Editions. Clients' federal data automatically transfers and calculates. Answer a few state-specific questions, run Alerts and finish state returns in minutes.

State 1040 features & benefits

Bundles & Save!

Buying multiple TaxAct products and want to save money? TaxAct's Software & E-file Bundles have everything you need!

Learn more about Bundles